This article may contain affiliate links. We may earn a commission if you make a purchase through them. Thanks for supporting the blog! Informational only – not financial advice. Always consult with a licensed financial advisor.

💼 Introduction: Wealth Isn’t Just Built — It’s Protected

Becoming wealthy might happen through entrepreneurship, inheritance, or a financial windfall — but staying wealthy is a different game entirely.

True long-term wealth isn’t the result of luck or timing. It’s the product of systems, psychology, and preservation-focused strategy. While many dream of hitting it big, the wealthy spend their time thinking about how to hold onto what they have — and how to pass it on intelligently.

This article explores the core reasons why the wealthy stay wealthy — and what you can learn from their methods to build durable, generational financial security.

🧠 The Wealth Mindset: How the Rich Think Differently

1. They Prioritize Ownership Over Employment

One of the clearest distinctions between rich and poor is that the wealthy focus on owning income-generating assets, not selling their time for money. They know that wealth is built by owning businesses, intellectual property, rental real estate, stock, or commodities.

“Don’t work for money. Make money work for you.” — Robert Kiyosaki

The wealthy ask:

- What can I buy or build that continues to pay me?

- How do I turn my income into capital?

2. They Think Generationally, Not Transactionally

Wealthy families operate on a timeline that spans decades. They build portfolios, trusts, and business models designed to last. A short-term gain isn’t worth much if it endangers long-term preservation.

Instead of making decisions based on immediate reward, they ask:

- How will this benefit my children?

- What would this asset look like in 20 years?

This patience-based strategy is one of the strongest reasons wealth compounds at scale.

3. They Avoid Lifestyle Creep

Many people increase spending as income rises. The wealthy consciously decouple income and lifestyle. They may spend on luxuries — but they don’t let ego drive expenses.

Wealth is preserved when expenses don’t expand in lockstep with earnings. That’s why many millionaires still drive older cars, buy used assets, or live in homes far beneath their means.

🔁 Compounding: The Multiplier of Generational Wealth

The most underutilized power in wealth building isn’t a new investment trend — it’s time.

The Math Behind Staying Rich

If you invest $1 million at an 8% annual return:

| Years | Value (No Contributions) |

|---|---|

| 10 | $2.16 million |

| 20 | $4.66 million |

| 30 | $10.06 million |

| 40 | $21.72 million |

Wealthy families let their capital work undisturbed. They protect principal, avoid emotional selling, and let time do the heavy lifting. Some family offices even have strict “no sell” policies to preserve capital continuity.

This is why the ultra-wealthy:

- Reinvest dividends

- Max out compounding accounts like IRAs and family trusts

- Prefer assets with reinvestment options (e.g., real estate, private equity)

💰 Asset Allocation: Building Stability First, Growth Second

Most people try to grow fast. The wealthy try to not lose — then let slow, intelligent compounding handle the rest.

They segment their portfolios across four key areas:

1. Preservation Assets

- Cash reserves

- Treasury bonds

- Precious metals (gold, silver)

- Insurance instruments

2. Growth Assets

- Blue-chip stocks

- Index funds

- Private equity and venture capital

- Income-generating real estate

3. Legacy Assets

- Family businesses

- Long-held properties

- Collectibles and art

- Dynasty trusts

4. Lifestyle Assets

- Yachts, jets, jewelry

- Vacation homes

- Experiential items (e.g., cars, vineyards)

The secret: They separate utility from investment. A home can be a lifestyle asset — but only if it appreciates and generates revenue.

🏘️ Real Estate: Where Wealth Meets Tangibility

Real estate is more than just a place to live. It’s one of the most trusted wealth preservation vehicles in existence.

Why the Wealthy Love Real Estate:

- Hard Asset – You can’t “hack” land or a building. It’s a real, usable store of value.

- Tax Advantages – Depreciation, mortgage interest, and capital gains benefits.

- Leverage – Borrowing lets them control more valuable property with less upfront capital.

- Cash Flow – Rental income can cover expenses and generate passive income for decades.

- Appreciation – Premium locations almost always rise in value over time.

Types of Real Estate Held by the Wealthy:

- Multi-unit apartment buildings in appreciating cities

- Luxury vacation rentals in exclusive resorts (Monaco, Cabo, Tulum, etc.)

- Commercial properties leased to global tenants

- Land banking in developing regions or near urban expansion

Wealthy families often place properties inside trusts or LLCs to protect from lawsuits, simplify estate planning, and reduce exposure.

🪙 Gold & Precious Metals: Wealth’s Ancient Hedge

Gold doesn’t rust, doesn’t default, and doesn’t go to zero. It’s held value for thousands of years — and remains a key holding in many family offices and generational portfolios.

Why Gold Is Still Held in 2025:

- It’s inflation-proof – Fiat currency weakens, gold strengthens

- It’s global – You can sell it anywhere

- It’s discreet – You don’t need a bank to hold it

- It’s reliable – While volatile markets collapse, gold remains steady

Wealthy investors often diversify their holdings with:

- Physical bullion in high-security vaults

- Gold IRAs for retirement protection

- Collectible coins with numismatic value

- Exposure to silver, platinum, and other metals

🟨 Ready to secure your future like the wealthy do? Get your free gold guide from GoldenCrest Metals

📚 Education: Wealth Is Taught, Not Just Inherited

The wealthy don’t assume money will last — they train their families how to protect it.

This includes:

- Hosting annual family financial meetings

- Hiring private educators for next-gen heirs

- Sending children to investment camps and legacy academies

- Giving small trust allocations early, with oversight

- Teaching the “story” behind the money — how it was earned and why it matters

Books like Family Wealth by James Hughes and Wealth 3.0 by Kristin Keffeler are regularly cited in UHNW circles.

👨👩👧👦 Generational Wealth Transfer: Estate Planning Like a Billionaire

Nearly 90% of inherited wealth is lost by the third generation. The wealthy who stay rich combat this with tools that extend control beyond the grave.

Tools They Use:

- Irrevocable Dynasty Trusts – Keep assets protected and growing for 100+ years

- Family Charitable Foundations – Combine legacy and tax deduction

- Buy-sell agreements – Ensure family businesses are passed down properly

- Letters of intent – Communicate vision alongside legal paperwork

- Annual gifting strategies – Minimize estate tax while supporting heirs

Rich families rarely leave lump sums. They leave frameworks — with rules, advisors, and stewardship embedded.

⚖️ Legal & Tax Optimization: Keeping More by Knowing the System

Taxes are one of the biggest threats to wealth preservation. The wealthy understand tax code intimately — and hire top-tier advisors to legally reduce liability.

Examples of Tax Tools:

- Deferred income plans – Push taxable income into future years

- Cost segregation in real estate – Accelerates depreciation

- Donor-Advised Funds – Donate now, disburse later

- Foreign trusts or asset holding structures – International protection

- S-Corps and LLCs – Income splitting and limited liability

Wealth preservation is about playing chess, not checkers. The tax code is a toolbox — and the wealthy know how to use every tool.

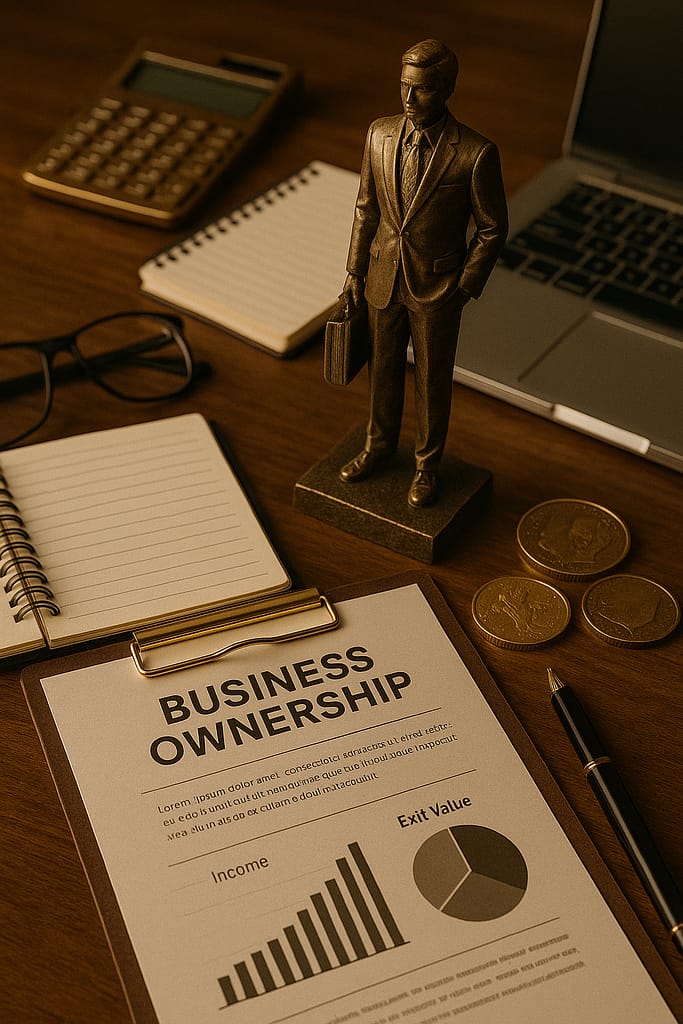

💼 Business Ownership: Passive Income + Exit Value

The majority of high-net-worth individuals own businesses. Not just for cash flow — but for equity and control.

Why Businesses Are Central to Staying Rich:

- They offer multiple streams of income

- They scale faster than employment

- They create assets that can be sold

- They provide lifestyle advantages (travel, networking, tax deductions)

- They can be passed down or franchised

Family businesses, private equity positions, and silent partnerships make up a huge portion of generational wealth.

🛡️ Risk Management: Insure, Protect, Defend

Wealth creates visibility — and visibility invites risk.

That’s why the wealthy:

- Keep real estate under separate LLCs

- Use umbrella liability insurance

- Keep minimal assets in their personal name

- Create firewall trusts

- Minimize online footprint and public disclosures

Rule of thumb: The more you have, the more you must hide, divide, and structure.

📣 Final Thoughts: Staying Rich Isn’t About Luck — It’s About Strategy

Wealth is a game of structure, not just income. The people who stay rich do so because they:

- Own the right assets

- Think in decades

- Build systems that outlive them

- Protect their wealth with intent

- Teach their children how to manage, grow, and respect money

You may not be born into a fortune, but you can learn the principles. And if you do — you won’t just build wealth… you’ll build a legacy.

🪙 Want to Diversify Like the Wealthy?

👉 Get Your Free Gold IRA Info Kit from GoldenCrest Metals

Learn how gold can preserve your purchasing power, protect your retirement, and build financial independence outside the stock market.

🏛️ Build Legacy the Smart Way

- Visit: GoldenCrest.info

- Request: FREE Gold IRA Guide

- Service: A+ rated concierge-style support

- Bonus: No-pressure consultations for discerning investors